When Will Prices for Construction Equipment and Material Settle Down?

Weakening demand has improved some construction equipment and material prices over the last quarter, but volatility is likely to continue into 2023, according to the latest market conditions report from Gilbane Building Company, one of the largest privately held family-owned construction and real estate development firms in the industry.

Jay Pendergrass, director of supply chain management and equipment for Gilbane, remains cautious:

“We have seen measures of supplier performance, delivery times, backlogs and shortages showing some improvement; however, risks remain for the supply chain for the foreseeable future.

“The continuing Russia/Ukraine conflict, uncertainty around the market’s response to the Federal Reserve’s monetary actions, port labor talks and other transportation disruptions, and new Covid lockdowns in China all continue to influence the supply and demand side for project materials and for cost and availability of equipment and materials.”

Variability in material costs and availability

While continued tighter financial markets, slower growth and sustained improvement of supply bottlenecks could ease prices in the last quarter of 2022, Pendergrass noted that it will take some time for markets to adjust:

“There are equipment and materials where we see a much longer duration of increased escalation and long lead times. Once inflation does peak, it will be a slow process for the costs to unwind on a global basis.

“While inflation rates may decrease, they remain at a level that is higher than typical. With global demand slowing and supply constraints easing in some areas, global inflation may moderate in 2023 and 2024 to more historic levels.”

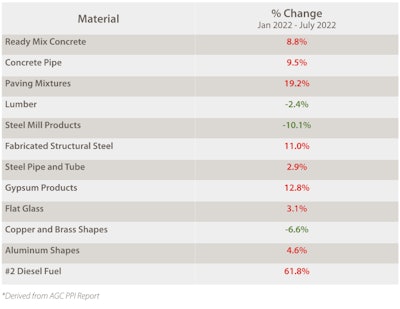

Year-to-date percent changes for select construction materials.Gilbane Building Company

Year-to-date percent changes for select construction materials.Gilbane Building Company

Despite elevated prices year-over-year, July brought some improvements for diesel, asphalt, lumber and some metals. Meanwhile, the prices of concrete products and some building materials continued to climb. Lead times for the products have remained variable as well.

“Some categories of equipment and materials have indeed seen decreased lead times, while others remain challenged,” Pendergrass said. “Looking forward, some top-of-mind continuing supply constraints and shortages for construction include semiconductors, electrical steel, construction sand, cement/concrete, and arguably glass.”

The range of lead times currently being experience in major categories of construction equipment and material.Gilbane Building Company

The range of lead times currently being experience in major categories of construction equipment and material.Gilbane Building Company

Pendergrass adds that while the $1.2 trillion Infrastructure Investment and Jobs Act will provide numerous benefits, it will put even more pressure on materials and labor supply, particularly with regard to cement and concrete.

Labor cost escalation continues

Because construction demand remains solid and the labor supply remains thin, workers will continue to hold the cards in wage negotiations. Wage growth has reached 5.7% on average nationally this year.

“Competition for workers in the construction industry combined with still-present inflation will keep wages supported through 2023,” Pendergrass said.

“While rising interest rates will begin to weigh on hiring altogether, it will take some time for slowing GDP growth and demand to translate into weaker wage growth.”

This sentiment was echoed in a recent market report from Turner Construction.

In its Third Quarter 2022 Turner Building Cost Index – which measures costs in the non-residential building construction market in the United States – Vice President Attilio Rivetti said: “We are experiencing a robust market with numerous mega-jobs. A shortage of skilled labor continues to lead contractors to be more selective in the projects they pursue. Wages are increasing to attract more labor into the industry and to incentivize skilled labor to travel to meet project needs.”